International Society for Comparative Economic Studies

20 YEARS OF ARNOLDSHAIN SEMINAR20 Years of Challenges for Integration, Globalization, and Development

September 14 – 18, 2015

Frankfurt and Arnoldhain / Taurus

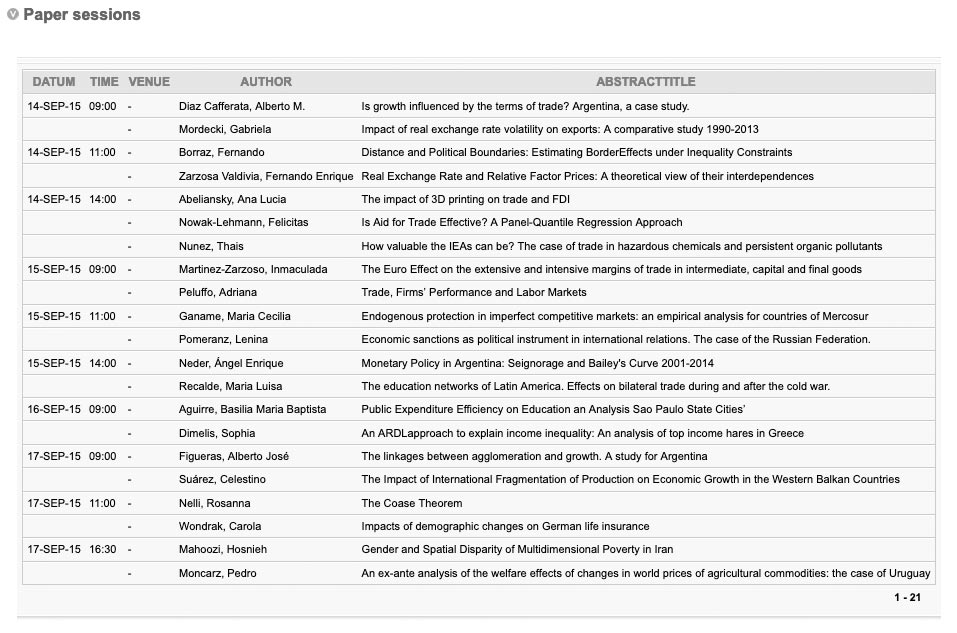

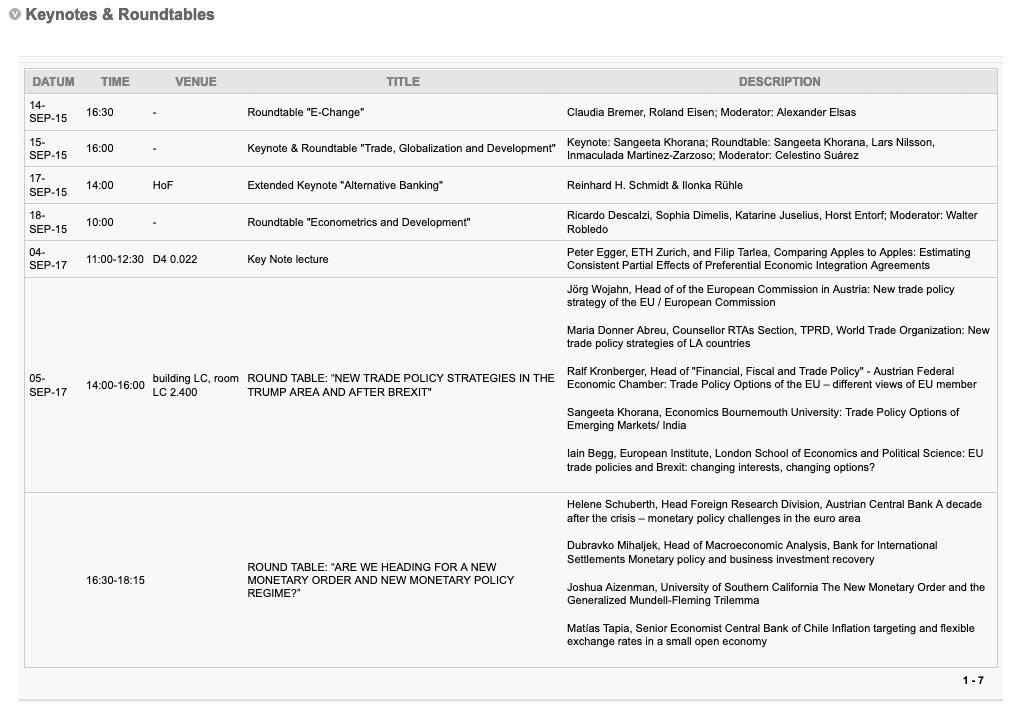

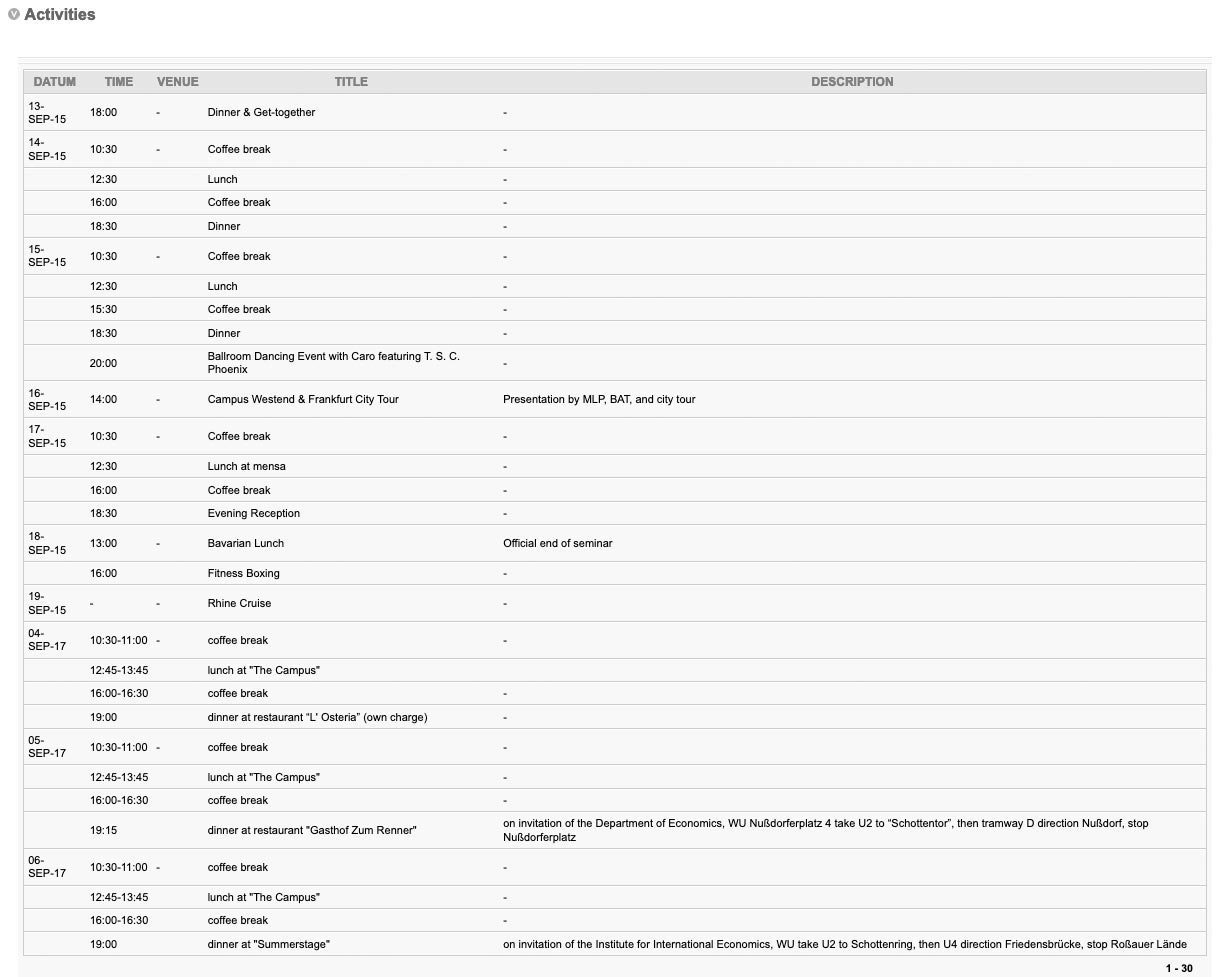

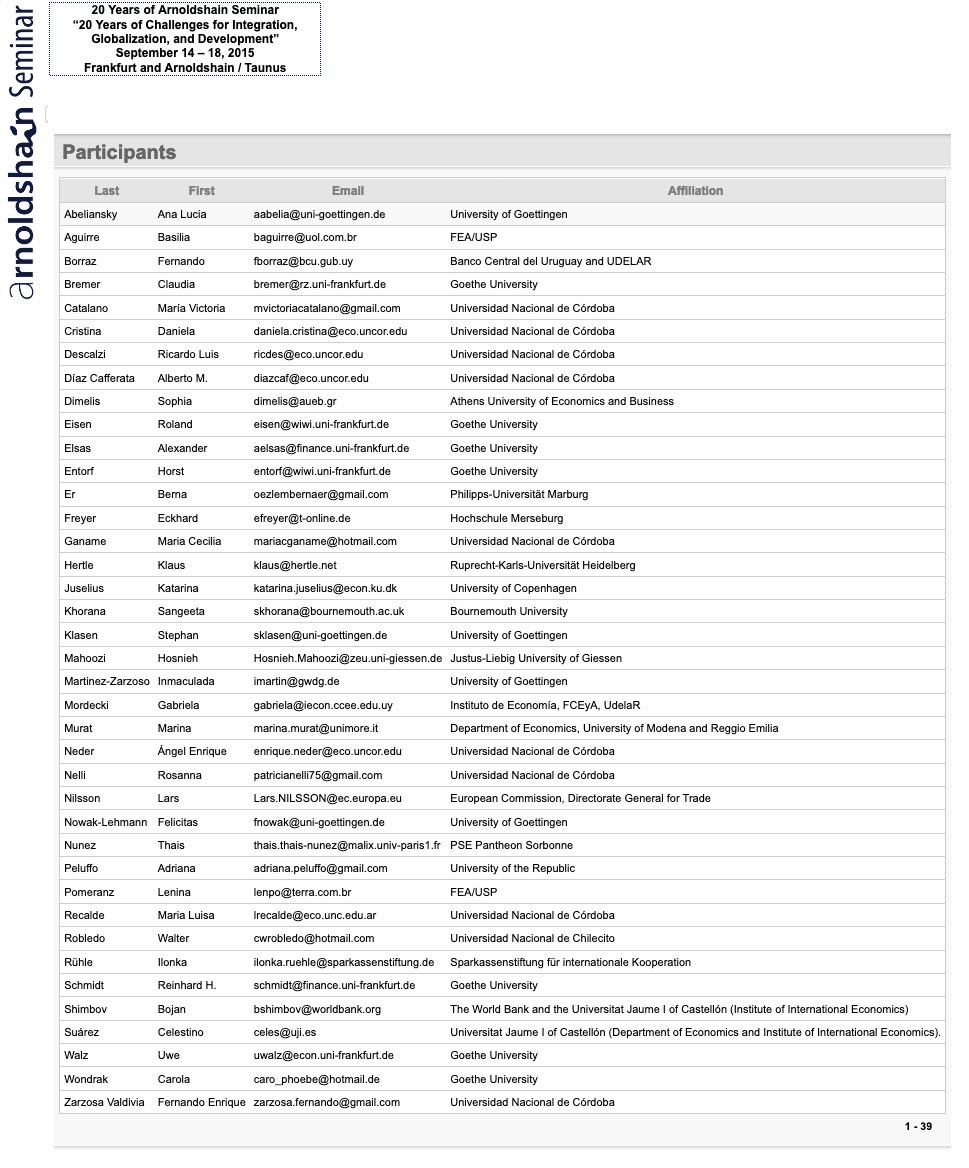

Sessions

Abstracts

- Abeliansky, Ana Lucia

- Aguirre, Basilia Maria Baptista

- Borraz, Fernando

- Diaz Cafferata, Alberto M.

- Dimelis, Sophia

- Figueras, Alberto José

- Mahoozi, Hosnieh

- Martinez-Zarzoso, Inmaculada

- Moncarz, Pedro

- Mordecki, Gabriela

- Neder, Ángel Enrique

- Nelli, Rosanna

- Nowak-Lehmann, Felicitas

- Nunez, Thais

- Peluffo, Adriana

- Pomeranz, Lenina

- Recalde, Maria Luisa

- Suárez, Celestino

- Wondrak, Carola

- Zarzosa Valdivia, Fernando Enrique

Abstracttitle

The impact of 3D printing on trade and FDI

Co

co-authored with Inmaculada Martinez-Zarzoso, Klaus Prettner

Shortabstract

This paper analyzes the effects of 3D printing technologies on the volume of trade and on the structure of FDI. A standard model with firm-specific heterogeneity gener- ates three main predictions. First, the model predicts that 3D printers are introduced in areas with high economic activity and subject to high transport costs. Secondly, technological progress related to 3D printing machines leads to a gradual replacement of FDI using traditional production structures with FDI using 3D printing techniques; at this stage international trade stays unaffected. Finally, at later stages, with 3D printing machines being widely used, further technological progress in 3D printing leads to a gradual replacement of international trade. Empirical evidence indicates that countries subject to higher transport costs and with high levels of economic ac- tivity are indeed among the ones that import more 3D printers.

Presenter

Date

14-SEP-15

Time

14:00

Venue

Abstracttitle

Public Expenditure Efficiency on Education an Analysis Sao Paulo State Cities’

Co

co-authored with Priscila Natacha de Oliveira

Shortabstract

This paper aims to evaluate public expenditure efficiency on education in the Sao Paulo State municipalities’ and to identify its performance main determinants. The methodology used consisted in a two stage non-parametric method. The first comprise the calculation of efficiency scores through Data Envelopment Analysis (DEA). The second is a Tobit regression model in which the scores constitute dependent variables and the exogenous factors (non-discretionary inputs) are the independent variables. The regression made possible estimate the efficiency level of each of the Sao Paulo State municipalities considering discretionary and non-discretionary inputs effects over efficiency. Then regression residuals where utilized as measures of “purely technical efficiency”. This can be considered a measure of public resources management efficiency once consider the potentialities of each municipality. The municipalities ordering differences’ obtained with DEA and from the residuals where not small and indicate a significant influence of the municipalities’ socio demographic characteristics over education’s performance and efficiency. Among the most efficient municipalities it is possible to find both big and small ones. The big municipalities lose this position when the non-discretionary inputs effects over efficiency are considered and then they are included in the less efficient group. The municipalities with a small number of inhabitants are maintained as the most efficient. Probably the small municipalities’ better performance is determined by the capacity of its citizens to monitor the behavior of school public servants and politicians and follow closer how public resources are spent thanks to the proximity that exists among people in these smaller communities.

Presenter

Date

16-SEP-15

Time

09:00

Venue

Abstracttitle

Distance and Political Boundaries: Estimating BorderEffects under Inequality Constraints

Co

co-authored with Alberto Cavallo, Roberto Rigobon, Leandro Zipitría

Shortabstract

The ‘border effects’ literature finds that political boundaries have a large impact on relative prices across locations. In this paper, we show that the standard empirical specification suffers from selection bias and propose a new methodology based on binned-quantile regressions. We use a novel micro-price dataset from Uruguay and focus on city borders. We find that, when the standard methodology is used, two supermarkets separated by 10 km across two different cities have the same price dispersion as two supermarkets separated by 30 km within the same city, implying that crossing a city border is equivalent to tripling the distance. By contrast, when upper quantiles are used the city border effect disappears. These findings imply that transport cost have been systematically underestimated by the previous literature. Our methodology can be applied to measure any kind of border effect. We illustrate this in the context of online–offline price dispersion to measure an ‘online-border’ effect in the city of Montevideo.

Presenter

Date

14-SEP-15

Time

11:00

Venue

Abstracttitle

Is growth influenced by the terms of trade? Argentina, a case study.

Co

co-authored with José Luis Arrufat, Sergio M. Buzzi, María Victoria Catalano

Shortabstract

Do Argentina’s high terms of trade (TOT) volatility impair its economic growth? Is there a policy problem? In this paper we test the null that volatility doesn’t matter. We use an annual 1810-2014 sample to examine whether the GDP growth pattern is Granger-caused by (unobserved ex ante) TOT uncertainty, which we proxy by several measures of the ex post peculiar high volatility of its TOT. The null hypothesis of no influence is posed for econometric estimations of causality, with a rolling window SD as our benchmark and other admissible volatility indices generated by detrending, decycling, and correcting for expectations formation. We find weak evidence in subperiods of a negative relationship between TOT volatility and the pattern of GDP growth.

Presenter

Alberto M. Diaz Cafferata & María Victoria Catalano

Date

14-SEP-15

Time

09:00

Venue

Abstracttitle

An ARDLapproach to explain income inequality: An analysis of top income hares in Greece

Co

co-authored with Chrissis, K., Livada, A.

Shortabstract

In this paper the empirical findings of the response of top income shares to changes in macroeconomic activity in Greece for the period 1960 to 2009 are discussed. Following the Piketty (2001) methodology, the upper income shares estimates are based on income tax statistics. Current literature on income distribution utilizes tax data in order to study top income shares. This study employs the Autoregressive Distributed Lag (ARDL) (or bounds testing) cointegration procedure for the empirical analysis of the long-run relationship and dynamic interacting among the variables of interest. The empirical findings suggest that economic development has played an equalizing role for Greece in the long-run as documented by its negative impact on the very upper income shares (1% and 2%). This result however is not uniform as it does not hold for the 5% upper share. Trade liberalization of the Greek economy has increased inequality, except for the 5% upper share where the long-run relationship does not seem to hold. The empirical findings further suggest that inflation reduces income inequality in the long run as documented by almost all proxies, again with the exception of the 5% top income share (no relationship). Finally, the financial development and population seem to exert no effect on the three top income shares in the long run.

Presenter

Date

16-SEP-15

Time

09:00

Venue

Abstracttitle

The linkages between agglomeration and growth. A study for Argentina

Co

co-authored with A. Daniela Cristina, Valeria Blanco, Iván Iturralde, Marcelo Capello

Shortabstract

This paper analyses the linkages between agglomeration and economic growth in the Argentinean provinces for the period 1981-2007 using both pooled and panel data estimates. The results are consistent across agglomeration proxies, control variables and estimation techniques. The effects of agglomeration on growth would increase with income, suggesting the presence of a Reverse Williamson Hypothesis. Therefore, Argentinean provinces with a high income level would benefit more from economic concentration than those in an earlier stage of development.

Presenter

A. Daniela Cristina

Date

17-SEP-15

Time

09:00

Venue

Abstracttitle

Gender and Spatial Disparity of Multidimensional Poverty in Iran

Co

Shortabstract

Demonstrating frequency, intensity and disparity of poverty among the various gender and spatial subgroups of the society is the main intention of this paper. Respecting the demands, to the extent admitted by the available data, of Sen’s (1987) Capabilities Approach to the assessment of human well-being, this paper estimates multidimensional poverty in Iran. In this study Alkire-Foster method is applied, which is flexible to use in various context of data and dimensions, and is able to capture the intensity as well as the incidence of poverty. In order to estimate disparity of poverty, the multilevel regression models have been utilized with the premise that the households are nested within provinces. Therefore, the disparity of poverty incidence -between and within provinces- was estimated using a multilevel logit regression model, while the variation of intensity of poverty among the poor was estimated applying multilevel linear model. The results concluded remarkable disparity among different subgroups in Iran, while the female-head households and rural households are heavily disadvantaged compared to the male-head and urban peers.

Presenter

Date

17-SEP-15

Time

16:30

Venue

Abstracttitle

The Euro Effect on the extensive and intensive margins of trade in intermediate, capital and final goods

Co

co-authored with Florian Johannsen

Shortabstract

The aim of this paper is to provide empirical evidence on the relationship between currency unions and trade. The novelties with respect to previous research are threefold. First, monthly trade and exchange rate data are used to take into account the short term effects of volatility in the bilateral exchange rate. Second, disaggregated trade data are used to deal with differences among industries and between intermediate, capital and final goods. Finally, the existence of zero trade flows is taken into account by distinguishing between the extensive and the intensive margins of trade. Investigating the impact of exchange rate volatility and the Euro at the same time allows us to disentangle the effect of a common currency beyond the elimination of any variation in the exchange rate. Furthermore, the developments of the past years with the financial crisis and the EU enlargement to the east are taken into account, yielding additional findings and policy implications.

Presenter

Date

15-SEP-15

Time

09:00

Venue

Abstracttitle

An ex-ante analysis of the welfare effects of changes in world prices of agricultural commodities: the case of Uruguay

Co

co-authored with Sergio Barone, Ricardo Descalzi

Shortabstract

During most of the past decade, Uruguay benefited greatly from an increase in the international prices of its main commodity exports. However, taking into account that most of the country’s exports are commodities that are used as inputs in the production of staple goods, there exists the potential to hurt a sizable part of the population, especially households at the lower end of the income distribution. Like in Moncarz et al. (2014), we run a Vector Error Correction Model (VECM) to estimate the long run elasticities of consumer prices with respect to international prices of Uruguay’s main commodity exports. Then, following the methodology pioneered by Deaton (1989), we run nonparametric regressions to obtain the welfare impacts on households along the expenditure distribution. The results show that, ex-ante, poorer households are the most negatively affected through the increase in consumer prices, especially of food and beverages (see Figure 1). On the other hand, a second channel works through the labour market. Here, we estimate an extended Mincer-type equation to obtain the elasticities of wages to changes in international commodity prices. The results show that poorer households benefit, while there is a reduction of income for those at the upper end of the distribution (see Figure 2). Overall, all households are affected negatively, with losses ranging between 10% and 14%, with poorer households suffering the most (see Figure 3).

Presenter

Ricardo Descalzi

Date

17-SEP-15

Time

16:30

Venue

Abstracttitle

Impact of real exchange rate volatility on exports: A comparative study 1990-2013

Co

co-authored with Ronald Miranda

Shortabstract

Raw materials exports of exporting countries depend on global demand and prices, but the increasing volatility of real exchange rates (RER) introduces an influence which impact varies according to the situation. Thus, this paper studies the dynamics of RER volatility, estimated through GARCH and IGARCH models for Brazil, Chile, New Zealand and Uruguay during the period 1990-2013. Then, for each country we study the potential impact of exchange rate volatility on total exports using Johansen’s methodology and analysis of impulse response functions, including also proxies for global demand and international prices. The results suggest that exports depend positively on global demand and international prices; however conditional RER volatility resulted not significant for the group of selected countries, with the exception of Uruguay, where RER volatility affects negatively exports, in the short and long term.

Presenter

Date

14-SEP-15

Time

09:00

Venue

Abstracttitle

Monetary Policy in Argentina: Seignorage and Bailey’s Curve 2001-2014

Co

co-authored with Ricardo Descalzi

Shortabstract

Governments usually do not admit they are causing inflation deliberately. They try to take advantage of this situation, promoting populist actions. They issue money to fund increasing spending on subsidies and transfers, causing strong increases in prices with the consequent welfare loss. Funding fiscal deficits by issuing money (seignorage) allow us asking ourselves why governments use seignorage when they know that this action leads to a higher inflation. In trying to find the answer, we should distinguish the role of economic institutions by comparing the Central Bank behavior between developed and developing countries. The main hypothesis in this paper is that in countries as Argentina, with an inflationary long story, the rate of inflation needed to sustain a given long run fiscal deficit is higher than in other emerging economies. We analyze the monetary policy in Argentina and stress possible differences with the policy applied in other emerging economies of the European Union.

Presenter

Date

15-SEP-15

Time

14:00

Venue

Abstracttitle

The Coase Theorem

Co

Shortabstract

The deterioration of the biosphere is a growing problem, especially since the Industrial Revolution. However, in this century, the destruction of the biosphere reaches its highest point: Almost the whole world is threatened by destruction. The extinction of the rainforests is paramount, since its destruction threatens life in our planet. One of the most outstanding economists in the issue of environmental protection and sustainable development was Ronald Coase, who created the famous “Coase Theorem” in 1960. After the creation of this theorem, there was a great production of critical literature, known at present as the “Coase Controverse”. The aim of this work is the interpretation and discussion of the consequences of the use of the “Coase Theorem” and the focus is going to be on the socioeconomic characteristics of the countries that have rainforests in their national territories.

Presenter

Date

17-SEP-15

Time

11:00

Venue

Abstracttitle

Is Aid for Trade Effective? A Panel-Quantile Regression Approach

Co

co-authored with Inmaculada Martínez-Zarzoso, Kai Rehwald

Shortabstract

This paper investigates whether Aid for Trade (AfT) leads to greater exports. Using panel data and panel quantile regression, our results suggest that overall AfT disbursements promote the export of goods and services in the short and in the long run, but mainly for the lower quantiles (0.1; 0.25; 0.50) of the conditional distribution of exports. This effect essentially vanishes at the higher tail of the distribution. Hence, countries that export less in volume are those benefiting most from AfT. We also investigate which types of AfT are effective. Aid to improve trade policy and regulation is associated with higher exports for all quantiles, with the effect increasing at the higher end of the distribution. Aid to build productive capacity is effective for the lower quantiles of the export distribution, with the effect decreasing at the upper tail of the conditional distribution. Aid used to build infrastructure is found to affect exports at only the lowest tail of the distribution. In contrast, aid disbursed for general budget support (an untargeted type of aid) is not associated with greater export levels. This finding holds true irrespective of the quantile.

Presenter

Date

14-SEP-15

Time

14:00

Venue

Abstracttitle

How valuable the IEAs can be? The case of trade in hazardous chemicals and persistent organic pollutants

Co

co-authored with Inmaculada Martinez

Shortabstract

Recent research has questioned the effectiveness of International Environmental Agreements (IEAs). Some IEAs are seen as a result of the country’s enthusiasm to give a reliable image on the international sphere, rather than legitimate domestic or international environmental concerns. This paper focuses in two specific environmental agreements, the Rotterdam Convention on hazardous chemicals and the Stockholm Convention on persistent organic pollutants. It explicitly evaluates the effects of the ratification of these agreements on imports of hazardous chemicals and persistent organic pollutants. Our results are twofold. Firstly, ratification of the Rotterdam Convention by two trading partners is not associated to any significant change of hazardous chemicals for exports from OECD to non-OECD countries. Similarly, the ratification of the Stockholm convention is also not associated to lower imports of persistent organic pollutants for exports from developed to developing countries. Secondly, in both cases bilateral trade shows no significant decrease between members after the ratification, indicating the lack of effectiveness of both conventions. The main policy recommendation is that political actors should support a fast implementation and compliance with the accords should be encouraged.

Presenter

Date

14-SEP-15

Time

14:00

Venue

Abstracttitle

Trade, Firms’ Performance and Labor Markets

Co

Shortabstract

This work presents a picture of Uruguayan manufacturing firms. To this aim we combine data on firms’ characteristics from the Annual Economic Surveys (Encuesta de Actividad Economica) with data on exports and imports from the Customs Direction. We analyse trade concentration as well as performance premia associated to international activity for firms that export and import (two-ways traders), only exporters and only importing firms. Firstly, we find that, in line with previous works, trade is more concentrated than employment and sales. Moreover, we find that two-ways traders are the best performing firms, followed by only exporting firms. Finally, we analyse product and country extensive margins of imports and exports and finding that the product extensive margin of imports and the country extensive margin of exports have a positive effect on two key variables: total factor productivity and employment.

Presenter

Date

15-SEP-15

Time

09:00

Venue

Abstracttitle

Economic sanctions as political instrument in international relations. The case of the Russian Federation.

Co

Shortabstract

The paper intends to discuss the application of economic sanctions as political instrument in international relations and the ones contemporarily used by the USA and other Western countries in different political situations. It is divided as follows : i) the understanding of economic sanctions in general and in their use in international relations; ii) a brief review of the sanctions applied to Cuba, Iraq and Iran, the declared objectives to obtain and their actual results; iii) the case of economic sanctions against the Russian Federation. Their objectives, their consequences to country’s economy, the reactions of the Russian authorities and, finally their results for the international economic and political relations; iv) concluding remarks on the subject.

Presenter

Date

15-SEP-15

Time

11:00

Venue

Abstracttitle

The education networks of Latin America. Effects on bilateral trade during and after the cold war.

Co

co-authored with Marina Murat, Pedro Degiovanni

Shortabstract

University students tend to build friendship and social ties that may last for a life time and evolve, in some cases, into business links. Latin American students have conspicuously started to move abroad during the sixties and seventies of the last century. With the end of the cold war, outgoing numbers grew rapidly. Do these movements influence the bilateral trade flows between students‟ countries of origin and destination? And, if they do, is this influence constant through time? Is it related to the types of goods traded, or to specific characteristics of sending and receiving countries? This paper tests the effects of students‟ movements from eleven Latin-American countries into nine OECD economies on bilateral trade flows during years 1971 to 2012. We use several cofactors, different econometric specifications and controls for endogeneity. Our main results are that education networks have positive and significant effects on bilateral exports and imports. In particular, the impact of students on trade is higher during the cold war period than afterwards, when the proportion of differentiated goods traded increases, but the political, cultural and institutional similarities between origin and destination countries improve significantly. We find the impact of education networks to be robust to different specifications and regressors. Governments should implement specific policies to trigger international student movements.

Presenter

Marina Murat

Date

15-SEP-15

Time

14:00

Venue

Abstracttitle

The Impact of International Fragmentation of Production on Economic Growth in the Western Balkan Countries

Co

co-authored with Bojan Shimbov, Maite Alguacil

Shortabstract

A clear consequence of the increasing integration of the world’s economies has been the internationalization of production. In this globalization process, the Western Balkan countries have not been an exception. With their recent integration into the global markets, an increasingly large share of their trade flows entails intermediate and unfinished goods that should be eventually processed and exported. Thus, the purpose of this work is twofold: on the one hand, to analyze the impact of international fragmentation of production on the economic performance of a country and on the other hand to test the hypothesis that trade created by international fragmentation of production may generate distinct effects on economic growth than trade in final goods. In the econometric analysis we employ a set of panel data models taking into consideration several control variables and alternative econometric methods. Given the availability of data, we focus on the period 2002-2013.

Presenter

Date

17-SEP-15

Time

09:00

Venue

Abstracttitle

Impacts of demographic changes on German life insurance

Co

co-authored with Bojan Shimbov, Maite Alguacil

Shortabstract

Ongoing discussions concerning problems in life insurance focus on the low yield environment and the problems caused by the new regulation, Solvency II, which demands for a much higher equity stake to secure payments. With these threats, the governmental retirement system cannot secure payments high enough in future times and also company pension plans experience problems with the resulting pension gapsi. A problem that separates the 87 German life insurance companies from the other European life insurers is the aging of the population living in Germany. The pension plans are financed by the contributions of the working population. With people having better conditions, people age better, have the risk of longlivety and not enough people to be born to finance the retiring cohort. The focus on people who already have a life insurance contract is now to use it as a retirement savings plan. Currently, there are more life insurance contracts signed than Germans. This means that the current population (that values savings and is able to save) holds more than one contract. A second impact of the new born cohort is that fewer life insurance contracts are sold. Hence, the amount of life insurance contracts is growing out. Therefore, three research questions can be asked: 1) How is the system of German life insurance built? 2) How is it affected by the German population? (low yields, search for security, values, aging population) 3) What way are there to solve the problem? This paper tries to evaluate the problems and derive solutions as well as giving a brief introduction on the life insurance market in Germany, an analysis of the news flow and a brief overview of ongoing mergers that are caused by consolidation in that market.

Presenter

Date

17-SEP-15

Time

11:00

Venue

Abstracttitle

Real Exchange Rate and Relative Factor Prices: A theoretical view of their interdependences

Co

Shortabstract

Based on a micro-founded model of a small open economy, this paper investigates the interdependences between the real exchange rate (defined as the relative tradable to non-tradable prices) and the relative factor price. On the one hand, the influence of the relative factor price on the real exchange rate is determined by the equilibrium of the goods markets (non-tradable goods sector market clearing conditions plus equilibrium of the current account). On the other hand, the equilibrium of the factor markets imply that the real exchange rates affect the relative factor price. When the goods and factor markets are in equilibrium, the real exchange rate and the relative factor price are determined. Consequently, this research also shows how this interdependences influence the channels by which productivity, factor endowments, terms of trade, government spending, debt services and transfers affect the equilibrium real exchange rate and relative factor price. The effect of economic policies should thus be evaluated by their influence in the interdependent and equilibrium relationships, which have not been studied yet by the current literature.

Presenter

Date

14-SEP-15

Time

11:00

Venue

Farben Campus. Das House of Finance